By David Cobham

The standard arguments against monetary policy responding to asset prices are the claims that it is not feasible to identify asset price bubbles in real time, and that the use of interest rates to restrain asset prices would have big adverse effects on real economic activity. So what happened with central banks and house prices prior to the financial crisis of 2007-2008?

Looking in detail at what the Federal Reserve Board (Fed), the European Central Bank (ECB) and the Bank of England (BoE) thought and said about house prices from the beginning of the 2000s, it appears that the Fed was so convinced of the standard line (monetary policy should not respond to asset prices but just stand ready to mop up if a bubble bursts) that it did not allocate much time or resources to discussing what was happening.

The BoE, on the other hand, while equally committed to that orthodoxy, felt the need to argue it out, at least up till 2005, and a number of speeches by Steve Nickell and others explained why they believed that the rises in house prices were a response to changes in the fundamentals (notably, the much lower levels of inflation and interest rates from the mid-1990s) and were therefore not a cause for concern. But after 2005 the BoE seems to have lost interest in the issue even to that extent.

Since the crisis the Fed and the BoE have produced analyses suggesting that monetary policy bore almost no responsibility for the house price rises, on the one hand, and that using interest rates to restrain them would have caused sharp downward pressures on income and employment, on the other. The trouble with these analyses is that they consider only the effect of interest rates being a little higher before the crisis, with everything else equal. But of course the advocates of ‘leaning against the wind’ (the minority view which has favoured using interest rates to head off large asset price booms) have always emphasised that the existence of such a policy needs to be known in advance, so that it feeds into the public’s expectations of asset prices and helps to stabilise them. The absence of any such expectations effect in these analyses means that they are wide open to the Lucas Critique, and their results cannot be taken as an argument against leaning against the wind in this case.

What this all amounts to is our conclusion that the failure to adequately monitor developments in the housing markets means that the central banks of the United States and the United Kingdom, in particular, cannot reasonably claim to have done all they could have done to mitigate the house price movements that were crucial to the incidence and depth of the financial crisis.

The main outcome of the crisis for the operations and strategy of monetary policy so far has been the creation of instruments and arrangements for ‘macro-prudential’ policies, which will indeed offer central banks some additional ways of addressing problems in asset markets. However, central banks need to take some responsibility for the debacle of 2007-2008 and its effects. And they need to find some way in the future to incorporate an element of leaning against the wind into their inflation targeting strategies, in case macro-prudential policies turn out to be inadequate.

It is not beyond the wit of man or woman to establish a central bank remit which has a primary focus on price stability but allows the central bank to react to other developments in extreme situations, as long as it makes clear publicly that this is what it is doing, and why, and for how long it expects to be doing it.

Such a revised remit would and should incorporate useful expectations-stabilising effects for asset markets. The transparency and accountability involved would also help to shore up the independence of the central banks (particularly the BoE) at a time when there is so much pressure on them from the political authorities to ensure economic recovery.

David Cobham is Professor of Economics at Heriot Watt University in Edinburgh. He is guest editor of Oxford Economic Papers April 2013 special issue on ‘Monetary policy before, during and after the crisis’, and co-editor of Oxford Review of Economic Policy spring 2013 issue on ‘The economic record of the 1997-2010 Labour government’.

Oxford Journals has published a special issue on the topic of Monetary Policy, with free papers until the end of March 2014.

Subscribe to the OUPblog via email or RSS.

Subscribe to only business and economics articles on the OUPblog via email or RSS.

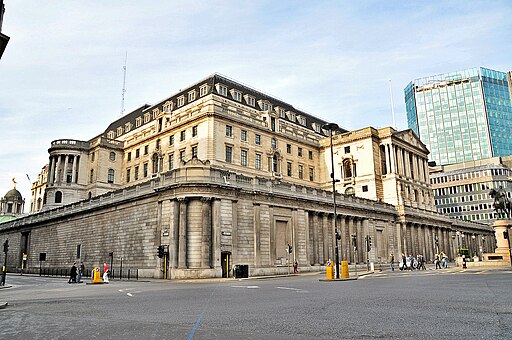

Image credit: Bank of England, Threadneedle Street, London. By Eluveitie. CC-BY-SA-3.0 via Wikimedia Commons

Recent Comments

There are currently no comments.